Jan 2020

If you find this read interesting, share it on:

At the outset I wish all of you and your families a very Happy New Year and a very healthy and successful 2020.

The year gone by…

2019 was a unique year for Indian markets. The aftermath of the IL&FS crisis left an indelible mark on the economy and the credit markets, considerably slowing down the economy from a growth of 7.0% in Q3CY18 to 4.5% in Q3CY19. In addition, the economy was also impacted due to disruptive structural reforms like demonetization, GST and RERA (real estate regulation act), all of which are positive in the long term but growth dilutive in the short term.

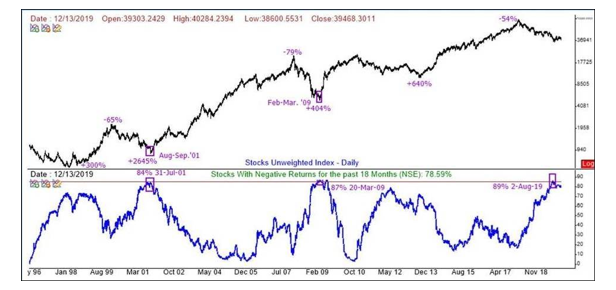

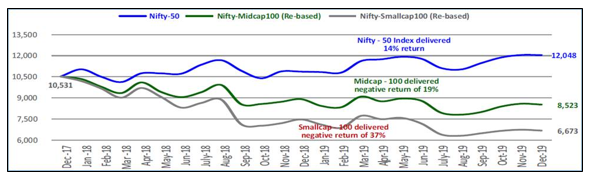

The narrow indices (NSE Nifty and BSE Sensex) delivered 12% and 14.4% returns respectively. However, this positive return completely masked the very poor breadth of returns in the broader markets. The Nifty Midcap index & BSE Small cap index delivered -4.3% & -6.8% returns respectively during the same period. The extent of polarization seen in CY2019 was at 20 year extremes and was matched by similar levels of polarization seen only during two other occasions: in July 2001, in the aftermath of the technology bust and in March 2009, post-Global Financial Crisis (GFC). The chart below illustrates that nearly 90% of the stocks listed on NSE showed negative 18-month returns till Dec 2019.

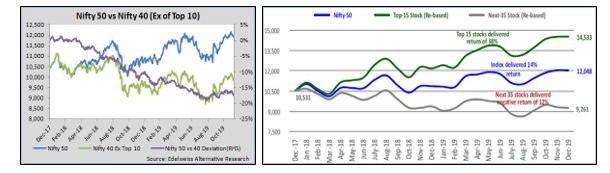

Even within the Nifty 50 stocks, the returns were skewed towards select 10-15 stocks, which delivered returns of 30-40% while the remaining stocks actually delivered negative returns.

We believe that a large number of businesses found it relatively difficult to navigate and withstand continuous regulatory disruptions mentioned above. This brought in an extreme phase of risk aversion and flight to safety which caused the Indian equity market to become extremely polarized in last 1-1.5 years.

Most incremental inflows in the Indian markets went to this select group of stocks due to their relative liquidity, safety, visibility of growth in some cases, and high quality nature of their business without any consideration for the current valuation. In addition, certain regulatory reasons caused significant outflows from small and midcaps which also contributed to their underperformance.

The stark difference between large caps and the broader markets (small and midcaps) is reflected in the negative returns of small-caps and mid-caps at -37% and -19% respectively during this period (Dec-17 to Dec-19)

Why we think this will change for the better…

1. Fiscal policy actions

After winning a landslide victory in May 2019, a sense of complacency crept in the government and focus shifted to fulfilling its social agenda such as scrapping Article 370, National Registry of Citizens/Citizenship Amendment Act, etc. However, the economic slowdown and its adverse impact on employment and incomes are starting to manifest in the loss of critical state elections previously ruled by the BJP/NDA post May 2019 (such as Maharashtra and Jharkhand). As a result, the government and its top functionaries have become aware of the negative impact of a continued economic slowdown on their ability to fulfil its economic and social agenda in future.

Since Sep 2019, the central government has sprung into action through various policy initiatives:

a. Tax rate cuts. There is a precedent of lower corporate taxes translating to higher investments in later years and a wealth effect trickling down in the economy. Considering the slow investment growth rate in India, government decided to cut corporate tax rates to 25.2% from 35% earlier and for new manufacturing units to 17% to bring it in line with the most competitive economies in Asia.

b. Support to the real estate sector. Real estate and construction contribute in a large way to creating employment and increasing the investment rate in the economy. The credit crisis and resultant slowdown has hurt this sector the most in past few years. As a result, government has taken several steps to improve the outlook for these sectors such as a dedicated Alternative Investment Fund (AIF) for incomplete projects, tax and interest rates incentives for affordable housing, etc.

c. Large strategic divestments/privatisation. Given the limited fiscal space and the inability to raise new tax revenues in the midst of a slowdown, government has been forced to embark on a privatisation drive to divest strategic stakes in certain large profitable PSUs such as Bharat Petroleum Corporation, Container Corporation of India, Shipping Corporation of India, etc.

d. Asset monetisation. The government is looking to sell completed projects in roads, power, communication, and gas pipeline infrastructure sectors to large infrastructure funds, sovereign wealth funds, and institutional investors.

e. Insolvency & Bankruptcy Code (IBC) amendments to ensure faster resolution. IBC was one of the landmark reforms of the current government in its first term. However, due to its limited history, there were several grey areas which required regular intervention of the judiciary and executive branches of the government from time to time, leading to delays in resolution. Finally, one of the first and large case of Essar Steel was resolved satisfactorily and that has set the groundwork for future resolutions as well. This reform is already helping the beleaguered banking sector to recover a lot from past NPAs and incrementally improving the banking system liquidity.

2. Monetary policy actions

In the past 1 year, India’s central bank, RBI, has been active led by the new governor, Mr. Shaktikanta Das by responding to the shocks and economic slowdown through several actions – reducing policy rates, resorting to sector specific liquidity requirements, and out-of- turn liquidity enhancing actions. After reducing rates and improving liquidity, focus is now on improving the transmission of these actions to the real economy.

3. Monsoon recovery and rural demand

The monsoons made a strong recovery in 2019 with overall rainfall exceeding 100% of the normal. The full benefit was not seen in the summer crop because of localised flooding and spatial differentials, but the sowing for the winter crop has been very strong. This, coupled with some food price reflation, should benefit the rural sector and help revive sentiment and demand. Many consumer companies (Hindustan Unilever is a prime example) had pointed out that the weakness in rural demand far exceeded that in urban areas, so a revival in agriculture could potentially cause a big swing in consumption growth.

4. Mean reversion in valuation & Corporate profitability

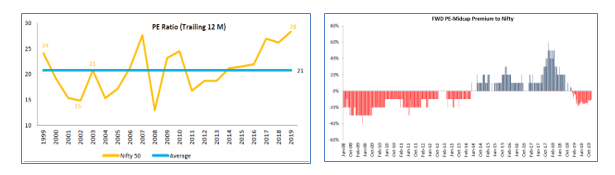

The divergence between small/midcaps and large caps has reached levels last seen in 2013, just before the next bull phase started and it is now too wide to sustain much longer. Clearly, this is not sustainable and we do expect a mean reversion. I truly believe that we are at an inflexion point in the cycle where this phenomenon should reverse over the next 2-3 quarters.

The valuation differential between large cap and midcap has increased in the past year.

At the same time, corporate profitability is also at a multi-decade low as seen below.

Both of these are unsustainable and will revert to their respective means. Hence, we expect valuation discount of midcaps to reduce going forward and corporate profits as % of GDP to improve on the back of a recovery in the economy.

Risks

Geopolitical events since the last week of Dec 2019 have reinforced the fragility of the current world equity market set up to unexpected shocks relating to higher crude oil prices. India is particularly vulnerable as it imports more than 80% of its requirements. Higher crude prices, if they sustain above USD 80 per barrel for some quarters, could pose a serious challenge to the fiscal and current account situation of the country resulting in a weakened INR and resultant impact on capital inflows.

In summary

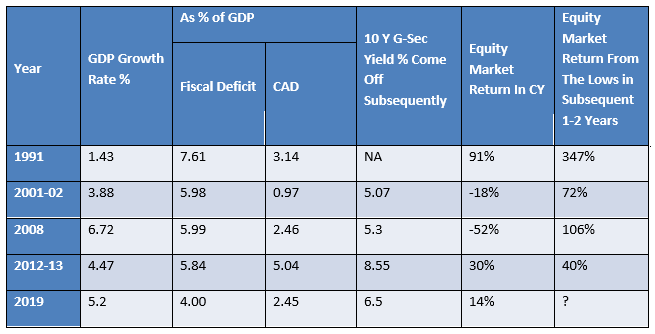

The current macro environment is reminiscent of past periods when the Indian economy slowed down significantly for several reasons. Such poor macro periods are reflected by slowing GDP growth rates, high fiscal and current account deficit as % of GDP. The challenging macro forces the government’s hand to initiate structural fiscal reforms (in this case, privatisation and corporate tax cuts amongst others) and loosen monetary policy to stimulate growth to revive the economy. The equity markets have in the past responded by delivering strong returns in years immediately following a tough macro environment.

We believe we are well positioned to benefit from a cyclical long term recovery in the economy, earnings and consequently improving breadth in the markets. Our portfolios have a good mix of steady high quality compounders and exposure to emerging growth companies and companies that would benefit from an economic recovery.

Hiren Ved

Chief Investment Officer

Alchemy Capital Management Pvt. Ltd

Source:

Alchemy Research

Bloomberg

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|3E2C14CD-8B2E-4251-885B-7227DDCAB241