Jan 2021

If you find this read interesting, share it on:

We see markets remaining strong through CY21, based on global liquidity and a recovering domestic economy. The x-factor is likely to come from a robust global commodities rally, which creates some peculiar conditions for the Indian economy and the markets. Our focus remains on being fully invested, well-diversified and picking quality stocks for our portfolio.

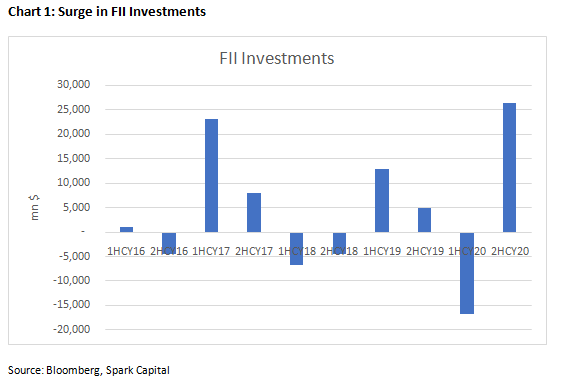

Global Liquidity Tailwinds: We expect the global liquidity rush to continue. The post-pandemic recovery has been muted globally, and global central banks are unlikely to pull the plug on their accommodative stance any time soon. There will be some pressures from inflation as the global commodity rally takes further hold, but that is unlikely to lead to a premature tightening of global liquidity. We see easy monetary conditions prevailing through the year, with a possible tightening cycle starting from 2022, depending on how the recovery pans out. We thus expect the strong FII inflows to sustain through next year, which underpins our overall bullishness on the market.

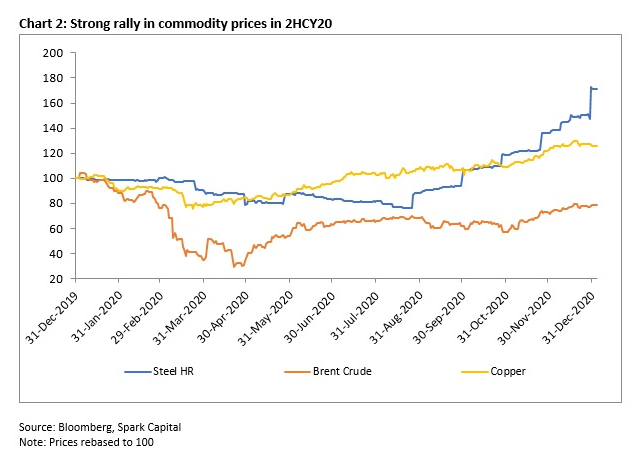

Strong Commodity Prices: There has been a strong rally in commodity prices in 2HCY20, and we expect the momentum to continue. This will be driven by a combination of a) the global liquidity glut b) improving demand especially from China and the US and c) the lack of a supply response, at least in the next 6-12m. There are some idiosyncratic factors like the China-Australia dispute that could make this a volatile ride, but we believe that commodity prices will remain strong through the year. This has multiple implications for Indian market:

-

Commodity stocks should do well on the back of these rally, even though return ratios and balance sheet strength for these companies is not the best. The companies that use this opportunity to deleverage and strengthen balance sheet could deliver disproportionate return to shareholders.

-

Inflation risks may be elevated for India. This has implications for India’s monetary policy, and there are no easy answers (discussed in a later section). Many commentators expect the current bout of inflation pressures to be temporary, but a sustained commodity price rally could put pressure on those assumptions.

-

Consumer companies’ margins could get affected. Stronger companies with robust franchises would pass these on but that would, at the margin, impact demand in an already-weak environment.

-

Sustained rally in oil prices could present policy challenges for India. Not only does it complicate the monetary policy, but it also put pressure on the government to cut indirect taxes on petroleum products and also disrupts the current account deficit. A moderate rally (up to ~$70/bbl) could be absorbed: anything above that will start to hurt

India’s Economic Recovery: We expect India’s economic recovery to continue. The contraction is expected to narrow as we reach the end of FY21, with probably a small positive in 4Q. As the base effect kicks in, we seea bounce back to near double-digit growth in FY22, which would take the GDP back to a similar level as FY20. It is the fine print that, however, will matter more to the markets. Four factors that we see as important:

-

The recovery is likely to be K-shaped, i.e., higher income segments are likely to do better. We aim to factor this into our stock selection process, trying to avoid mass-market consumer companies.

-

The manufacturing recovery is being led by a restocking cycle that will peak sometime in the next 2-3 quarters. Underlying consumer demand must accelerate for growth to sustain beyond that.

-

The recovery has been led by manufacturing sector so far, but services sector should kick in once the economy normalises.

-

The nascent recovery in residential real estate could be the “X factor” for the economy – the sustainability of this demand is, therefore, important.

Our base case, of course, is that there is no fresh flare-up in Covid cases, and the vaccine starts getting delivered over the course of the years.

RBI’s Trilemma: The RBI will be faced with tricky policy options in CY21. There will be some pressure to sterilise the heavy flow of overseas liquidity to keep currency appreciation under check, but that would add to the overflow of domestic liquidity. If inflation remains sticky, the RBI will be hard put to tighten domestic liquidity and avoid currency appreciation. We do believe, however, that the RBI would err on the side of caution and keep rates low and liquidity easy until growth is back on a firmer footing. It does, however, raise the risk of a sharp tightening in CY22.

Key Risks: We see three key risks. We have alluded to one already – the manufacturing cycle tails off as the restocking momentum falters and underlying demand remains weak. We see that more accentuated for companies catering to the mass market. The second is that global growth falters after the post-normalisation bump – our assumptions on commodity prices would then be challenged. The third is that the RBI moves earlier than expected on inflation and monetary conditions tighten. All three are relatively low probability, but we are closely watching these trends.

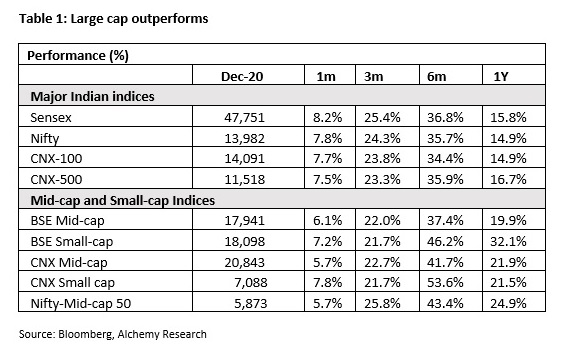

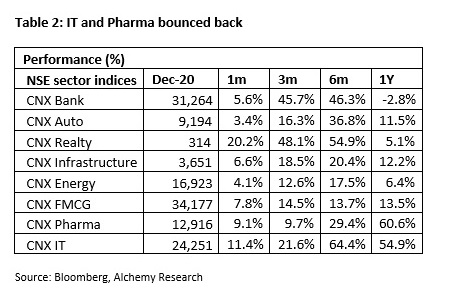

New Sector Leadership: We have seen a fair amount of sector rotation in CY20 – chemicals, pharma, IT, autos and financials all getting their moments in the sun with short spurts of outperformance. That trend will broadly remain the same. From a medium-term perspective, however, we believe that industrials and discretionary could outperform what appears to be a high-beta rally. We believe that the rally will be broad-based and unlike in the past, not dependent excessively on high quality financials and staples.

Our Approach: Our overall approach is likely to remain unchanged, based on the broad principles governing our strategy for the past few months. We wouldlike to hold very little cash and invest new flows as quickly as possible. We will endeavour to keep our portfolios diversified from a sectoral perspective. While we are size-agnostic in our stock-picking, we do see the share of mid- and small-caps rising over the year. Our focus will remain on market leaders with strong balance sheets and robust return ratios – we may, however, look at a few turnaround names where the balance sheets, cash flows and return metrics are incrementally improving off a low base. We are, also, looking selectively at some better-quality commodity names. We see tech and digital as a strong theme for CY21.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|934CC56F-2E37-4418-B186-F9779CFDA025