Dec 2021

If you find this read interesting, share it on:

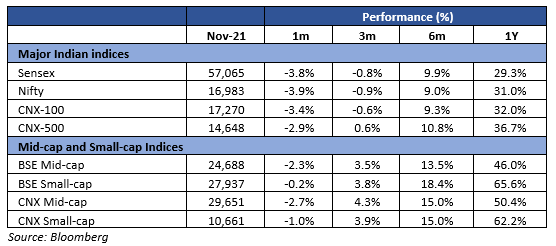

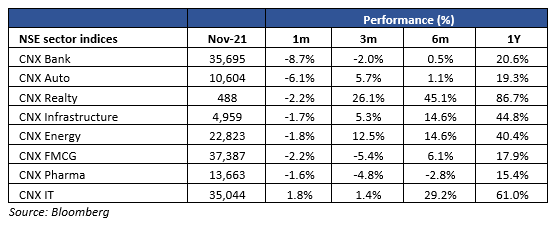

Multiple headwinds hit the market in November 2021 triggering a sharp sell-off. We think that most of the perceived negatives are being over-emphasised and this is a temporary phase. The economic recovery should drive a bounceback within months, though sectoral leadership could keep shifting. Earnings growth remains robust and broad-based and that is the main source of our confidence.

Portfolio approach

We continue our stance of remaining fully invested. Our sector focus is changing slightly from earlier:

- We are looking at new opportunities within the consumer sector. The worst margin pressures seem to be over, with calibrated price hikes and moderating commodity prices. Our bias is towards high-growth companies.

- We are re-orienting the risk in our cyclical exposure. We have trimmed positions in the commodities stocks, as we find better risk-reward opportunities in other sectors. We remain positive on industrials, but are looking at companies with steady growth and strong balance sheets.

- Exporters remain an area of focus. Some sub-sectors, like IT, appear to be expensive but we still see opportunities in companies where the growth runway is strong and can withstand the expensive valuations.

- We still find compelling ideas within opening-up trades, but are reckoning the higher risk from a third wave and are a little more cautious on valuations. We are not trimming our existing exposures, though given the lack of clarity on the developing situation surrounding a fresh wave of Covid infections.

Multiple negatives for the market

- Omicron. Covid-19 remains the biggest worry, with the emergence of a new variant and rising cases across Europe. India has remained resilient so far but a third wave, though unlikely, cannot be ruled out. It is difficult to factor such a binary, unpredictable event. We remain cognizant of the risks posed by a second wave but will adjust our portfolios when we have greater clarity, even if it means moving a bit late.

- The PayTM listing. India’s largest-ever IPO opened 27% below issue price on listing day. This was negative for market sentiment. The issue highlights the greater risk in internet companies. We also note that this is the first internet IPO with a weak opening – others delivered strong listing gains, Those stocks, in fact, remained strong even when PayTM was selling off. Thankfully, some subsequent IPOs have sailed through without much stress, indicating that this may not a systemic issue.

- Agri law repeal. The government announced the withdrawal of the contentious agricultural laws passed in 2020. This is a setback to reforms and will keep a critical part of the economy weak and inefficient for many more years. We do not, however, share the pessimism that this marks a U-turn by the government on other reform areas like asset monetization and PSU privatization. Also, the direct impact on broader markets is muted: very few listed companies deal directly with the agri sector.

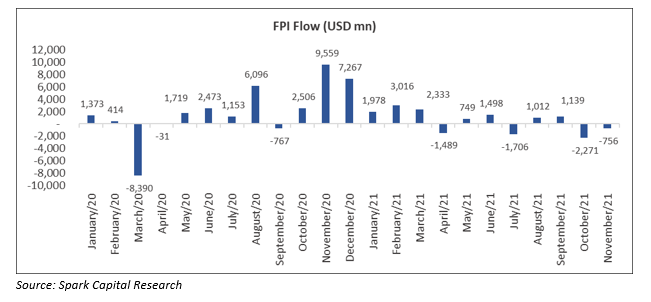

- Weak FPI flows. FPI flows seem to be drying up – probably a function of high headline valuations, end-of-year impact and downgrades by multiple brokerages. We think this is transient. We expect flows to start to come back as further evidence of growth (both macro and earnings) starts to filter through.

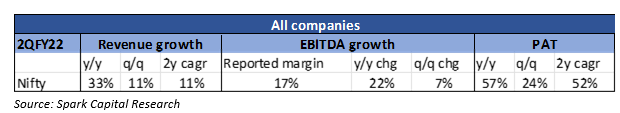

Strong earnings season

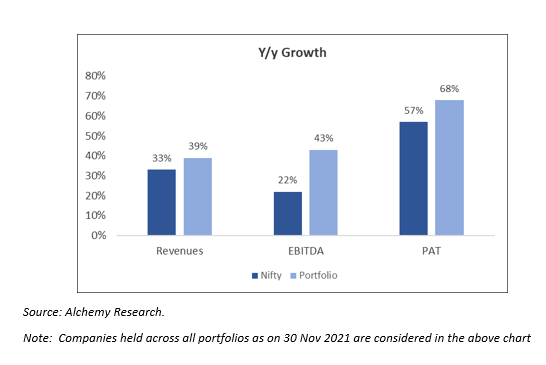

We believe that the 2QFY22 earnings season was a strong one. The only negative was the compressed margins for the consumer sector, which was expected and offset by strong growth from commodity companies. The margin issue is getting resolved as companies take price hikes and the commodity cycle weakens in intensity. EPS growth for FY23 and FY24 remains strong and broadbased, and we see the possibility of the resumption of earnings upgrades on the back of a strong consumption recovery, normalising margins and compressed credit costs for banks.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd

Source:

Alchemy Research

Bloomberg

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|AAE632FE-AA25-407F-A686-34EAFCC2259D