May 2021

If you find this read interesting, share it on:

We hope that you and your loved ones are safe and healthy. The second Covid wave has been more deadly and widespread than the first,and has had a devastating impact on many families. We would exhort you to observe all the necessary precautions – stay at home as far as possible, mask up when going out, wash and sanitise hands frequently and strictly observe social distance.

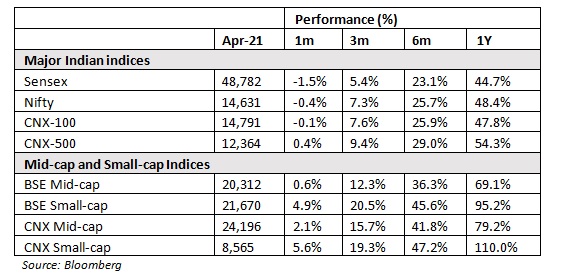

Markets have been resilient through the second Covid wave, largely due to two reasons. First, the global economy is on a strong recovery path, which has a rub-off effect. Second, the impact on domestic demand is expected to be temporary – as it was in 2020. Our view is that consumption-oriented sectors should see near-term stress, but market leaders with robust balance sheets will remain strong. On the other hand, industrials and export-oriented companies should continue to do well and will remain the leaders in this rally for a while longer.

The second Covid wave

While initially, the second Covid wave was localised in a few states in March, now it has progressed rapidly to the rest of the country. It has been particularly virulent in Northern India, putting enormous strain on healthcare infrastructure in many parts. The resulting humanitarian crisis has been deep, and has raised multiple risks: the quantum and direction of public expenditure, the pace of economic reform and a medium-term impact on consumption patterns.

Hope that the avoidance of a national lockdown would limit the economic impact is also ebbing, as the localised lockdowns in many major economic centres is likely to have a very strong effect. To summarise, our view is that the macro impact of the second wave will be more severe than was originally thought, but will still be transient and the economy should start to normalise by the end of CY21. Companies with strong franchises and balance sheets should recover faster than market laggards.

Earnings trajectory

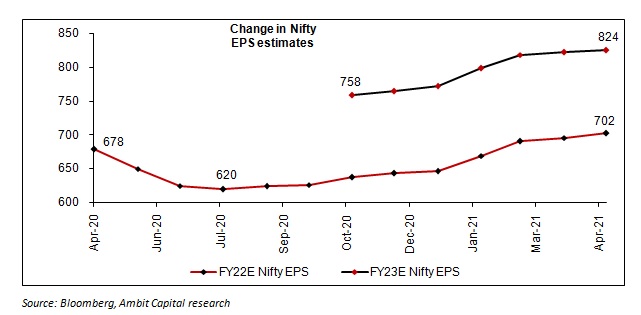

The 4Q earnings season has been patchy so far. ~60% of Nifty companies(As of 6 May 2021)have missed consensus forecasts, with bank provisions and gross margins being the main sources of disappointment. In a few cases, topline momentum has also been an issue.

There is a resultant pause in the FY22 Nifty EPS upgrade cycle: the 11% upgrade between October 2020 and April 2021 has now plateaued and there has been a marginal downtick in recent weeks. Around half the Nifty companies are yet to report and we will have a clearer picture by mid-May, but we reiterate the key trends we are watching in this earning season (flagged in last month's update).

Commodity prices: The strong momentum in global commodity prices are likely to squeeze producer margins in India. We think only some could be passed on and companies are likely to face a margin squeeze over 4QFY21 and 1QFY22. The ongoing results season and management commentary should give us some visibility on this issue.

Resilience of demand: The 4Q21 results will not reflect the full impact of the second wave of Covid on ps. However, management commentary on the FY22 outlook should give us some perspective – though, to be fair, it is very difficult for even managements to be able to predict the outlook in these unprecedented times.

Sustainability of cost improvements: Companies had managed to cushion the impact of Covid on FY21 earnings with aggressive cost management. That may be difficult to sustain in FY22 without damaging the long-term franchise of the companies. The FY22 earnings outlook will have to be judged in that context.

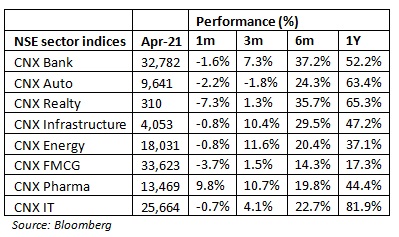

Sectors and companies

We are adjusting our overall sector positioning to ride through this period where the economy is likely to be under stress. The overall approach is to increase weightage towards sectors that can leverage the global economic recovery or the domestic investment cycle: industrials, capital goods, pharma, chemicals and IT. We are also dipping our toes in commodities companies where we see the scope of strong balance sheet improvement. On the other hand, we are being more selective in sectors that are dependent on domestic consumption: banking and financials, consumer discretionary, retail and FMCG. In these sectors, we are backing strong franchises with defendable market shares or potential turnarounds, and are willing to pay a valuation premium for these names.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd

Source:

Alchemy Research

Bloomberg

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|B1D767BF-1AA2-499F-9280-BC5E6552FCF3