Feb 2023

If you find this read interesting, share it on:

The strong Union Budget for FY24 is positive for the equity markets in the medium term. The fiscal prudence, combined with improved quality of expenditure, paves the way for a multi-year macro sweet spot - high GDP growth with stable financial conditions. In this context, we believe that growth stocks and quality will make a comeback in CY23, and the value rally is likely to fizzle out. The caveat is that valuations continue to matter and high PE stocks without support from earnings and cash flows may underperform. Also, we think the market will re-focus on quality metrics like strong balance sheets, return ratios and management strength.

Union Budget FY24

Capital Expenditure

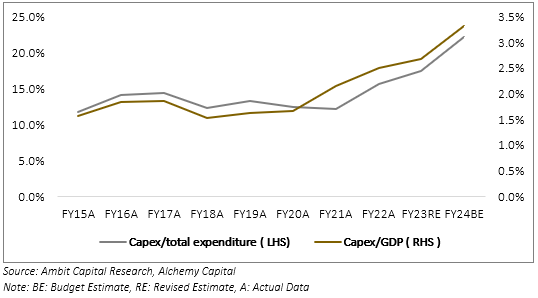

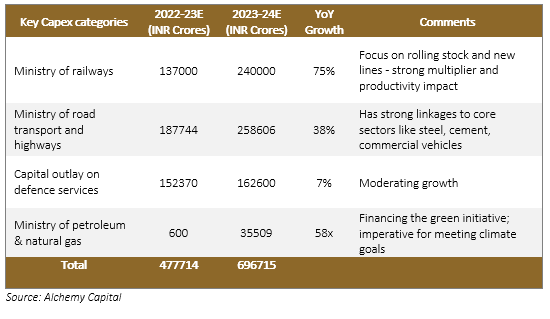

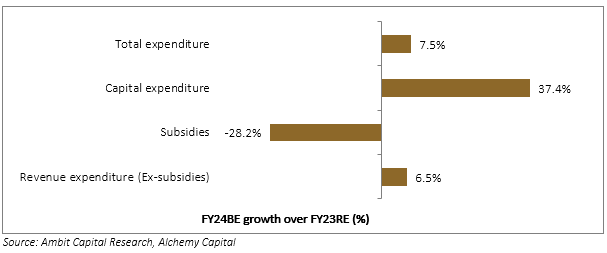

The standout feature was the surge in capital expenditure – raised by 37% to Rs 10tn. This was driven by increased allocation to railways, road construction and the green initiatives of the petroleum ministries. All these categories have significant multiplier effects on the economy and should help improve India’s long-term growth potential. This breaks the multi-year trend of India’s public spending shifting towards revenue expenditure (including subsidies).

Taxation

The other positive came from the direct tax proposals. Market fears of increased capital gains tax on equities proved unfounded – they were left untouched. In addition, there were marginal cuts in income tax rates across all income groups. In our view, the tax cuts are not material enough for a significant consumption boost, but we see them as a positive signal of the government’s approach to taxation.

Income Tax

There were marginal cuts in income tax rates across all income groups. The threshold for tax brackets was raised and the peak rate was cut to below 40%, which is a strong positive signal. The other important subtext is the strengthening of the new tax regime – we see clear signals that the government intends to fully transition to an exemption-free code over time.

Capital Gains Tax (CGT)

There were worries about a rationalisation of capital gains tax and a higher resultant incidence on equities. That was left untouched and, to that extent, a positive for the markets. We do not see the case for equating CGT across asset classes. The taxation of the underlying debt and equity are different and the CGT rates should reflect that difference, in our view.

Life Insurance

The new tax proposals are negative for life insurers in the medium term. At the bottom end, the transition to the new regime will reduce buyer incentives for the savings products, which are a large part of life insurers’ portfolios. At the top end, the capping of premiums at Rs 500k means that HNIs are now excluded from the market – as is the lifetime value of clients as upselling is capped beyond a point. This, we believe, would lead to a moderation of insurers’ rich valuations over time. We have been very selective about investing in this sector and will be even more cautious after this budget.

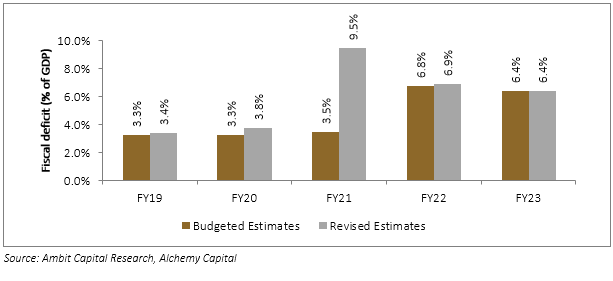

Fiscal Deficit

Sticking to the Consolidation Path

Despite these expansionary measures, the fiscal deficit contracted. A 50bps contraction to 5.9% in FY24 reaffirms the government’s commitment to bring the fisc below 4.5% by FY26. India had taken up the fiscal deficit targets in the wake of Covid and this is a good time to start to consolidate. A reduction in the fiscal deficit does constrain growth – but we think that the changing composition of spending towards capex cushions the impact. The flipside is that the conservative fiscal policy should help the overall financial stability and keep long bond yields in check.

Reasonable Assumptions

This has been achieved with moderate assumptions on tax collections. GDP growth assumptions are at a moderate 10.5% and tax collections are largely in line with that at 11.5%. These are reasonable buoyancy assumptions and we see very little risk of a shortfall. Interestingly, the tax collections for FY23 overshot the budget estimates – a rare occurrence in India’s history.

Key risk: Global Macro

Global macro is an imponderable here. The fiscal maths has been built on a sharp cut in food and fuel subsidies. This is reasonable – there was a one-off spike in FY23 due to global oil and commodity price inflation. If this assumption goes awry, however, the government may have less room to manoeuvre and may need to cut back on the planned capital expenditure to keep the fiscal in check. We shall be monitoring this trend closely.

Markets – Stick to Quality

Supportive Macro

Our constructive view on the markets is underpinned by an expectation of a robust macro. Sure, there are near-term growth challenges from a high base effect, slowing global growth, and the withdrawal of excess liquidity. Over the medium term, however, we believe multiple tailwinds will propel growth to a sustained, multi-year, 6%+ range.

• Consumption should recover as incomes continue to rise and inflation moderates from the post-pandemic supply shock.

• The capex cycle should recover, helped by both public and private spending. We have already seen anecdotal evidence of this in the order books of capital goods manufacturers and the budget outlay adds further momentum to that trend.

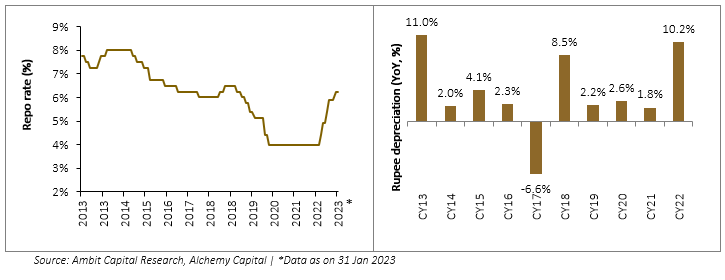

• We see an extended period of financial stability with interest rates topping out at levels that are in the mid-range of the historic range. Moreover, the currency weakness seems to be orderly and is unlikely to cause a major shock. This is helped, of course, by both corporate and consumer balance sheets being largely healthy following the deleveraging of the last 3-4 years.

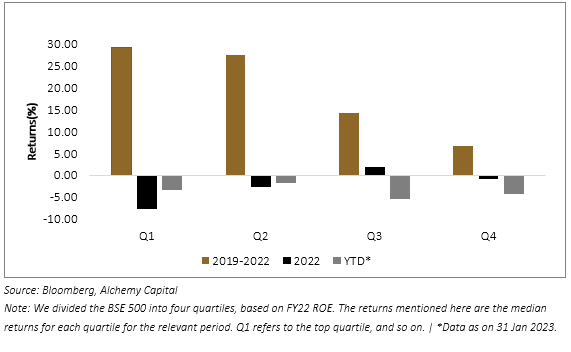

Key Mantra: Growth

We continue to focus on high-growth companies as our core investment thesis. The value rally of 2022 may not sustain into 2023, in our view – the re-rating seems to be over and it is difficult to find pockets of egregious undervaluation at this stage. On the other hand, the strong economic cycle is throwing up a broader set of high-growth companies to choose from, with strong balance sheets and high profitability ratios.

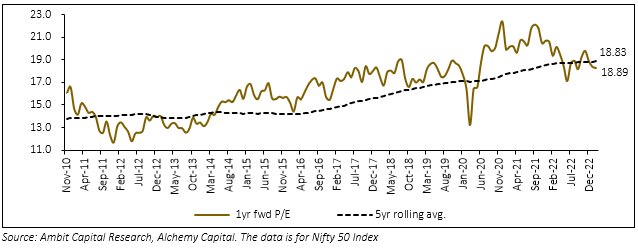

Tread Carefully on Valuations

The extended valuations on the broader market, however, make stock-picking more difficult. 2022 was brutal for companies with rich valuations, and many winners from the 2011-2020 decade have been consistent underperformers in the recent past. We continue to use valuation as a filter for high-growth companies and are careful of overpaying. We are not, however, averse to buying high P/E companies as long as growth and cash flows support these valuations.

Stick to Quality

High-quality companies were laggards in the value rally of 2022. Filters like strong balance sheets, quality management/business models, and robust return ratios did not seem to work last year. We see the tide already turning in 2023 and see quality making a comeback in CY23. We are sharpening our quality filters for our stock-picking and have exited exposures where we see challenges on the business or management front.

Adani Impact

Final word: We do not see the sell-off in the Adani group stocks triggering a broader contagion in the market. We had stayed away from this group due to our filters on leverage. We also, at this stage, do not see this triggering any sort of crisis in the financial system, as bank exposures are limited to ~1% of net advances, going by the disclosures made so far.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|5C980EAE-9805-4E17-9108-8424CB0D749D