Aug 2022

If you find this read interesting, share it on:

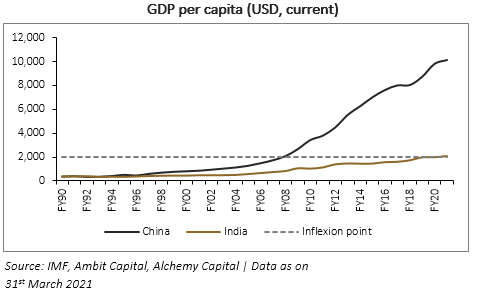

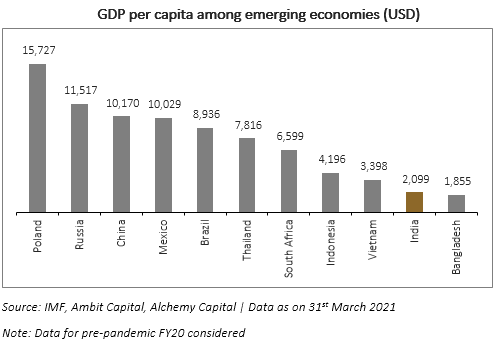

India is poised to enter a golden phase of sustained growth over the next decade. The opportunity was always visible, but we now see a confluence of unique strengths. Favourable demographics and per capita income crossing the crucial $2000 mark ^, coupled with structural enablers like digitisation and urbanisation make it more certain and probable. India’s macro strength and ability to withstand shock have improved with tax buoyancy, growing exports and comfortable FX reserves. There are challenges for sure – employment, health, education and sustainability but there are opportunities to alleviate these. We believe that growth can sustain with a supportive policy environment – and India must fashion its own approach to this. The paths taken by other countries like China may not suit India as the global environment has changed and India is, in many ways, a different economy and polity.

The impact on investors could be significant. We can no longer trust the rear-view mirror as there are some imminent trend changes and inflexion points, some of which are upon us. Our focus is to capitalise on these emerging themes, some of which will challenge the conventional wisdom of the teens.

PREMIUMISATION/LUXURY

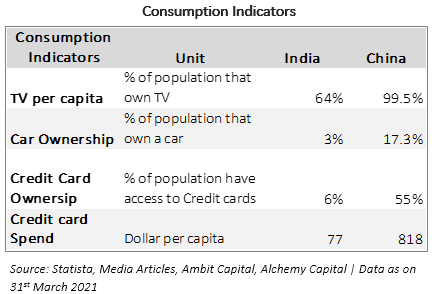

A multi-year period of growth should drive significant change in India’s consumption patterns. As India’s per-capita income progresses towards $3,000, we see a significant shift towards premiumisation. We expect significant income mobility into the middle classes, and that should propel demand for aspirational goods and services as consumers move to improve quality of living. At the top end, India could be one of the fastest growing segments for luxury goods and services, as witnessed in China when growth took off in the noughties (2000-2009).

MANUFACTURING

Indian manufacturing is set to come out of the long winter of the teens (2010-2019). We see three supportive drivers:

- Global supply chains are being reworked after Covid and the Ukraine war. The West is trying to reduce dependence on China for supply chains and India is the primary beneficiary. We think that China will remain dominant as the “world’s factory”, but even a small shift to India could make a big difference due to the small base.

- The government’s policies in raising import duties and supporting domestic manufacturing through schemes like the PLI should also provide a fillip to local manufacturing. Protectionism carries its own set of risks, but this is a unique opportunity, and a short-term support plan may work at this stage. There is some history in the auto sector where this strategy has worked.

- The difficult phase for Indian manufacturing, through the noughties, is now working to its benefit. Weaker players exited and the rest had to trim the fat and strengthen their businesses to survive. The survivors, therefore, are well-poised to capture this opportunity with lean cost structures and strong balance sheets. Another positive for investors is that capital allocation for many companies is now significantly better.

SUSTAINABILITY

India will have to forge a different path towards economic success as it will have to meet sustainability goals along with hyper-growth. We think that directionally, India will work to reduce emissions, but the trajectory may be slower than other countries so as not to slow economic progress. Nevertheless, we see some key changes that we should adapt to.

- Manufacturing practices. Companies will have to show incremental improvement in manufacturing processes to continuously reduce emissions. We are seeing this play out even in high-emission sectors like steel, where electric arc furnaces are making a comeback despite the cost challenges. We believe that more and more sectors will invest in reducing their emissions and carbon footprint.

- Emissions and EVs. Consumer products will also have to move to greener options over time. Autos are already facing this pressure, with the accelerated target for Bharat-6 set a few years ago. Going forward, we may see emission norms being further tightened. Moreover, electric vehicles can see an increasing presence in the market, progressing slowly through two-wheelers, passenger cars and CVs in that order. It may not happen immediately, but we believe that EVs are the future and will be dominant in the market when we exit this decade.

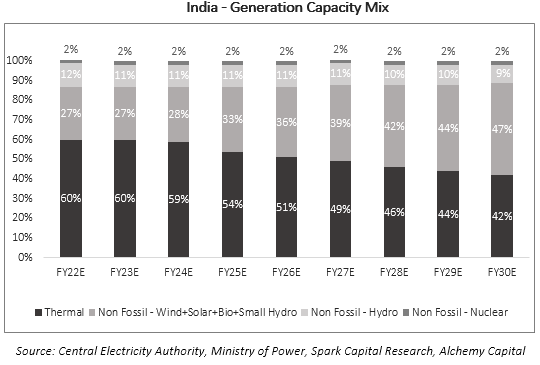

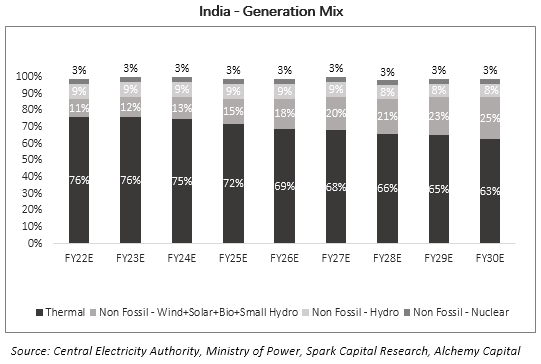

- Renewable energy. The third leg of this process is the shift towards renewable energy. India’s power requirements are too large for this shift to be dramatic, but we see aggressive investments in the renewable space that will reduce India’s dependence on fossil fuels for power. This will help develop an entire new ecosystem for renewable energy, some of which is already starting to be visible.

DIGITISATION AND DISRUPTION

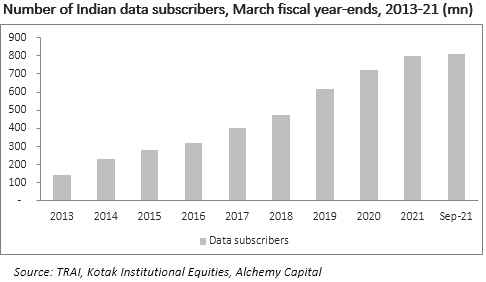

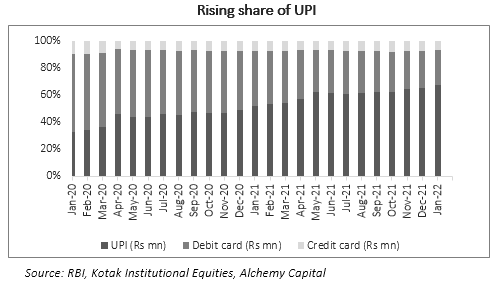

Two foundational pillars have driven a step-change in India’s mobile ecosystem. First, cheap data has driven up mobile penetration exponentially to levels that are matched by very few countries. Second, the explosion of UPI and its dominance over cards has further strengthened the digital ecosystem.

These lay the potential for exponential efficiency improvements and improving the delivery of private and government services to bottom-of-pyramid population. It has also democratized digital transactions and, potentially, led to a transformation of SMEs and their access to formal finance.

This has ushered in game-changing scenarios for internet and digital businesses and revolutionised many sectors in efficiency and consumer behaviour patterns. Food delivery and online shopping are two such examples.

We believe that these new age internet businesses offers a huge opportunity over the next few years. The macro story will be supportive of continued hypergrowth in these companies, and those who have consolidated market share are now seeing a path to profitability. Of course, these companies are relatively high-risk compared to traditional ones, but careful stock-picking can deliver high-return opportunities.

URBANISATION

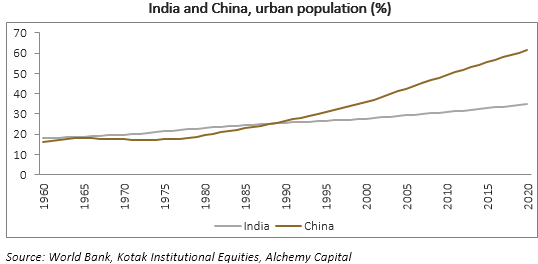

This is both a cause and effect of a long period of hyper-growth. India needs rapid urbanisation, on two fronts, to fulfil potential growth over the next decade. First, the urban renewal of existing cities needs to continue at rapid pace. Second, newer urban centres need to flourish beyond the top 5-6 large metros, to absorb the inevitable migration from rural areas. This is a virtuous cycle – urban renewal, if executed well, would itself propel productivity improvements, fresh industrial investment and further fuel growth.

Rapid urbanisation may offer new investment opportunities across multiple segments. The most basic of this will be in building infrastructure and housing, and some of that momentum is already visible. There would be second-order opportunities, too. Consumption patterns across categories would change as the migration progresses. Technology adoption and related services could also see sustained growth as some of these relate largely to urban centres (for example: home improvement and food delivery).

FINANCIALISATION OF SAVINGS

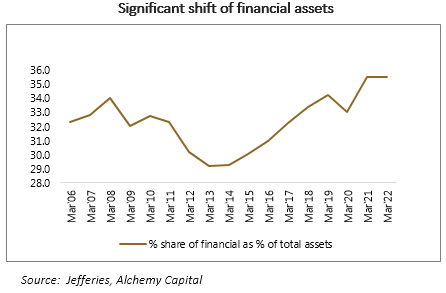

- Reforms over the last decade have driven a structural uptick in the financialisation of savings. This has been driven by a combination of negative impulses – regulation of real estate, tighter tax compliance, demonetisation – and some incentives to savings like greater digitisation of transactions.

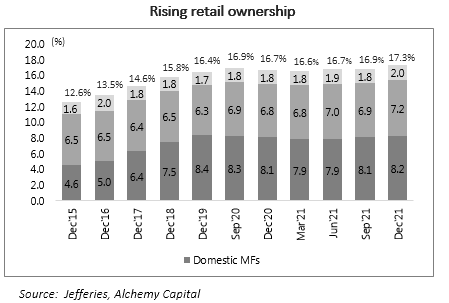

- India remains under-indexed on the exposure of household savings to equities, now at a mere 14%. We believe that this should trend up over time as per-capita income starts to cross certain threshold levels. This is critical on two fronts: it provides risk capital to industry to help prolong the growth cycle; and it creates the necessary resources for long-term pension planning for individuals.

- A corollary of this, in our view, would be greater participation of domestic investors in the equity markets. This helps onshore wealth creation on the one hand and provides a buffer against FPI selling – as it has partially done in CY22.

DEMOCRATISATION OF CREDIT

The fintech wave is different from other models that have disrupted India’s lending market. The newer players could help expand the market for formal financial services by offering bite-sized loans and other financial products. Newer technologies make it possible to make small ticket loans at an industrial scale – and this helps expand the market for consumption loans. This could change the spending patterns among lower-income groups, as they would now have access to leverage that was missing in the past. The small ticket sizes would make it possible to create this market responsibly, ie, not over-leverage the borrower.

We have seen some newer business models emerging over the last two years. These include transaction-based lending to SMEs and self-employed borrowers who would struggle to put together a formal credit profile. Much of this is being done in “fintech” mode – ie, based on data without going through complex offline credit appraisal practices.

This has an impact at two levels: first, it allows newer players to enter the lending market as the legacy players are unwilling and unable to develop these businesses. Secondly, it provides a fallback at the bottom of the pyramid and strengthens the ability of SMEs and self-employed professionals to ride out a down-cycle.

CHALLENGES, BUT CAN BE OVERCOME

The next few years will pose some challenges to the sustainability of growth, and we believe there need to be some decisive policy initiatives to counter this. Our key worries are de-globalisation, challenges in building health and education infrastructure (where the state has to play a role) and bringing market impulses to the agri sector. High growth should, in our view, create enough government revenues to fund initiatives in these sectors, but state capacity and center-state relations remain key issues.

- De-globalisation. Increasing autarchy, especially on immigration, could hurt India. This could be transitional if countries realise that the long-term benefits of globalisation are still very strong. However, India will have to navigate this tricky geopolitical environment and develop bilateral relations across the world to protect its own interests.

- Blue-collar employment has been a challenge over the past 6-7 years, partly due to the slower growth and external shocks in the late teens. The silver lining is that we seem to be coming out of that slump, but policy should be supportive of employment-generating sectors to ensure the sustainability of the growth momentum. Some measures like PLI are doing just that; but need to be supported by other steps like labour reform, simplification of compliance and taxes and a generally benign environment for investments.

- Health and education remain a challenge. The good news is that high growth and tax buoyancy should help create more resources to target these issues. However, state capacity in both these areas is weak, and the private sector, in our view, is an imperfect solution. Given the challenges, the solutions should be creative and collaborative (between governments, state and central, and the private sector) with substantial investments a necessary condition. We draw comfort from India’s past success in engineering and technical education.

- India’s agriculture sector needs reform. The current format of low farmgate prices, subsidised inputs and state-led output pricing has created distortions and depressed productivity. The reform package announced in 2020 was, unfortunately, shelved but the government needs to keep engaging the farming community and push for these reforms. The share of agri is shrinking in India’s GDP but it remains a large employer. The long-term health of this sector is critical for sustainable growth.

CONCLUSION

Our analysis leads us to believe that we are at the cusp of a long spell of high returns for Indian equities. There will, of course, be cyclical challenges and volatility, but the rewards far outweigh the risks. From a longer term perspective, however, Alchemy Capital believes that this decade will be stronger for equities than the previous one.

The other difference is that we see this as a far broader market. The teens were marked by a narrow range of stocks that delivered the returns – we do not see that repeating this time around. Off-Nifty stocks, therefore, probably offer better opportunities than the top end market-cap companies.

Note: ^ India crossed $2000 mark in FY21.

Hiren Ved | Co-Founder, Director, CEO & CIO

Seshadri Sen | Head of Research

Alchemy Capital Management Pvt. Ltd.

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|BAD7A275-8258-4061-83C7-40BE5B213393