Sep 2022

If you find this read interesting, share it on:

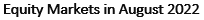

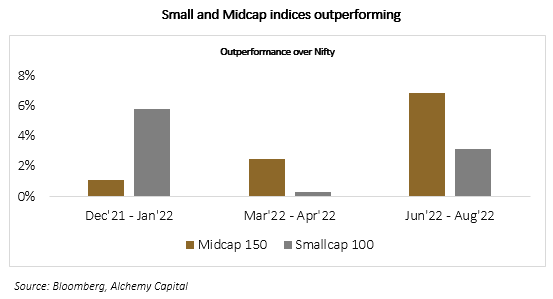

Indian markets remained strong through August 2022 and we continue to be bullish on markets. The breadth of the current rally, with mid and smallcaps outperforming, reinforces our confidence. We believe that investors should look through near-term volatility and ensure that their long-term allocation to equities remains stable. Timing the markets remains risky and holding back in anticipation of a correction may turn out to be a suboptimal strategy. We continue to minimise cash and aim to deploy fresh inflows generally within a month.

Powering Through Tightening

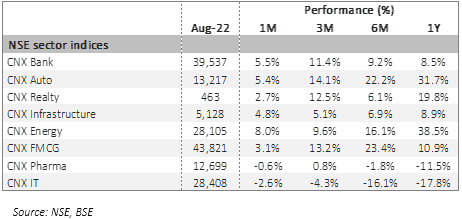

Global and local financial conditions have been tightening through the last few weeks; with greater intensity since the cautious speech by Fed Chairman Jerome Powell at Jackson Hole on 26-Aug 2022. The Fed and the RBI have continuously tightened through CY22 and the DXY has rallied strongly. Nevertheless, the Indian markets have rallied by 17% since 20-Jun 2022, with better breadth than any of the other mini-rallies in CY22.

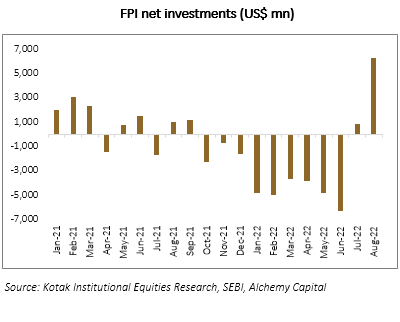

This counter-intuitive move is an illustration of the challenges in predicting short-term movements in the broader market. The biggest positive, of course, has been the abatement of FPI selling in the markets, which was probably front-loaded in 1HCY22 in anticipation of continued Fed tightening – incremental rate hikes are thus not affecting flows to the same extent.

Positive Fundamental Triggers

The headwinds of global tightening are being offset by multiple positives on the domestic macro:

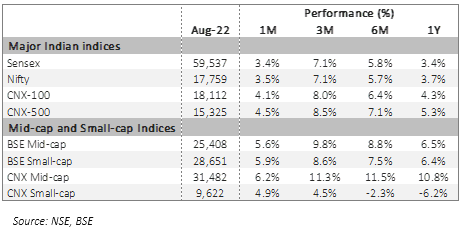

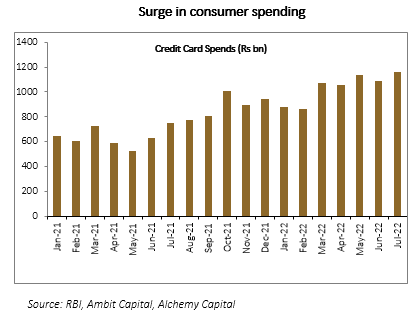

- Consumer demand remains strong, despite high inflation. Mass market products are still struggling, but the premium markets seem to be growing across categories, with autos making a strong comeback in FY23. One of the strongest evidence is from the surge in credit card spends, some of which is coming from high-contact services segments like travel and tourism.

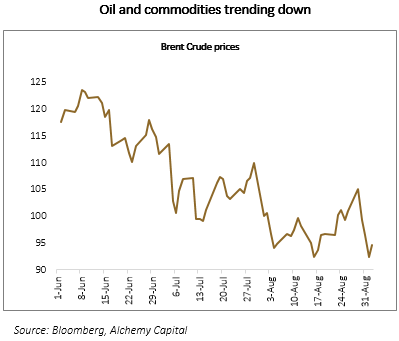

- Global commodity prices are steady-to-weak, led by global oil prices. This should help moderate headline inflation in 2HFY23, and also give companies breathing room to improve margins, hold prices or invest for growth.

- The capex revival continues. The outlook for government spending remains bright, especially with the buoyancy in tax revenues that is coming through. Private capex is also kicking in, led by a combination of strong underlying demand, continued export opportunities and favourable policy conditions.

- The rupee has been holding firm, despite the DXY strength. As we discussed in our last month blog, the rupee has a strong long-term correlation with equities and its relative strength is expressing itself in the resilience of the broader equity markets.

Breadth of the Rally

The breadth of the latest of three mini-rallies in CY22, has been notable. The midcap and small cap indices have significantly outperformed the Nifty in the mini rally since 20 June 2022, and the gap seems to be trending upwards. The stronger participation from off-index stocks is, in our view, part of a longer-term trend. As we enter a sustained period of steady growth for the Indian macro, the markets are unlikely to be concentrated like in the decade ending 2020.

Earnings Review

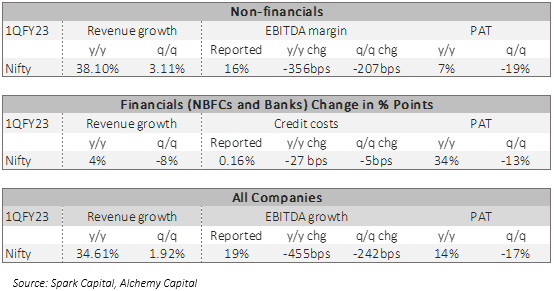

The 1QFY23 earnings season was largely positive, and reinforced the positive momentum in the markets.

- Top-line growth remained strong, though coloured by a weak base. The two-year CAGR is still somewhat muted, indicating that the economy has probably still not returned to full potential after COVID. We think that the momentum will continue to improve through FY23 on the back of strong consumer demand and continued revival of capex.

- Margins pressures continued this quarter. This should start bottoming out from here. The worst of the commodity price impact seems to have been absorbed over two quarters in 1HCY22, and companies dealt with it by a combination of cost-cutting and price hikes. That cycle seems to be approaching the end.

- The results from financials were exceptionally strong. Top-line returned with loan growth and fees rebounding, whereas credit costs were unusually low, given the risk aversion since the pandemic and aggressive provisions through FY21/FY22. PAT growth was hurt by one-off bond losses, and should start normalising from 2QFY23.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|EC34EDF3-5FAD-4BEB-9DDE-B12BC1EAC3BF