Aug 2025

If you find this read interesting, share it on:

In today’s world, much is being said about the US Dollar (USD). But to truly understand its future, one must first explore its past. Like any investment asset, knowing the history and evolution of the USD helps form a clearer view of its current role and future trajectory. This note aims to explain the origins, historical milestones, global rise, and current challenges of the USD in simple terms.

Origins: A Coin with European Roots

Once upon a time in 16th-century Europe, a silver coin called the “thaler” was widely trusted. Centuries later, its name echoed across the Atlantic in a young nation searching for identity—the United States.

After gaining independence in 1776, America needed a currency that people recognised. The Spanish peso, rooted in the thaler, was already familiar. So, in 1792, the US officially adopted the “dollar”, introducing a smart new idea: decimal currency—1 dollar = 100 cents. As the country grew, so did its money.

Building Trust: Gold, Silver & Paper

-

1857: Foreign coins phased out. Before this, coins like the Spanish dollar and Mexican reales were commonly used, especially in the early years of the US when domestic coin production was limited. The coinage Act also allowed people to exchange foreign coins at the US Treasury for newly minted American coins.

-

1861–1865: Civil War leads to the creation of greenbacks—paper money not backed by metal. While risky at first, they showed that the government could support a currency based on trust and legal authority. Over time, this laid the foundation for today’s fiat dollar, proving that confidence—not just metal—could sustain a currency.

-

1900: The Gold Standard Act backs the dollar solely with gold. It gave the dollar a fixed value, backed by gold, ensuring stability, credibility, and confidence—especially in global trade.

-

1913: The Federal Reserve is established to stabilize the currency. Federal Reserve gave US a central authority to manage money and banking. By making the financial system more predictable and resilient, the Fed helped people and markets trust the US Dollar more deeply.

Global Rise: Bretton Woods: A Global Endorsement of the USD

-

After World War II, 44 allied nations agreed to peg their currencies to the US Dollar, which was convertible to gold at $35/ounce. This effectively made the dollar the anchor of the global financial system.

Why it showed confidence:

The US held most of the world’s gold reserves.

It had the strongest post-war economy.

The dollar was seen as stable, reliable, and trustworthy. This agreement marked the beginning of the USD’s role as the world’s reserve currency.

1971: USD Goes Fiat — Global Acceptance

When the US President Nixon dropped gold backing in 1971, the USD became a fiat currency. Despite concerns, it was accepted globally because of the US’s economic strength, the dollar’s dominance in trade, and a lack of viable alternatives. Trust in US institutions kept the dollar central to global finance.

1973–1974: The Petrodollar system- A Boost for the USD

Once the dollar was no longer backed by gold, the US needed a way to maintain global demand for its currency.

The solution: Convince oil-exporting nations (starting with Saudi Arabia) to price oil in USD.

In return, the US offered military protection, economic cooperation, and access to US financial markets.

This created a self-reinforcing cycle:

Countries needed USD to buy oil.

Oil revenues were recycled into US assets, especially Treasury bonds.

The USD remained dominant, even without gold backing.

Rise of the Fiat Dollar and Floating Exchange Rates

-

Global Shift: Other countries like UK, Japan , Germany moved away from gold-backed currencies. Exchange rates began to float, meaning they were determined by market forces like supply and demand.

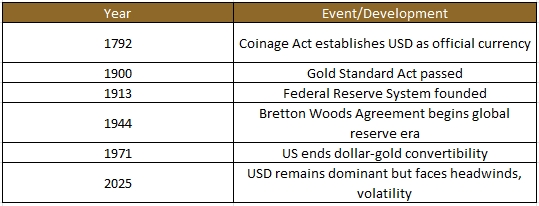

US Dollar — Historical Milestones and Global Turning Points

The Dollar in 2025: Relevance and Challenges

The U.S. Dollar Index (DXY) faces mounting risks, recording its worst first-half performance in over 50 years, signaling a profound structural shift in global markets.

This market regime change is driven by:

• Fiscal Deterioration: The U.S. is projected to face annual deficits of $2.0–$2.5 trillion for the next decade. The “Big Beautiful Bill” could add $4.1–$5.5 trillion to the national debt by 2034, pushing debt to 127% of GDP.

(Source - An Update to the Budget and Economic Outlook: 2024 to 2034 | Congressional Budget Office The Senate OBBBA in Charts-2025-06-30)

• Trade Policy Impacts: Rising tariffs (15.1%, highest since 1938) increase costs and uncertainty.

• 'Revenge Tax' Threat: Proposed taxes on foreign-held U.S. assets could reduce demand for USD.

• Threat to Fed Independence: Political pressure may weaken Fed credibility, risking inflation and force debt control.

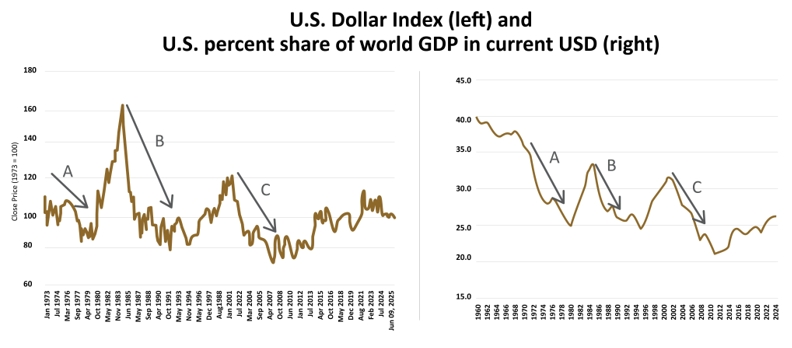

These factors may lead foreign investors to reallocate away from the U.S. markets. Historically, U.S. global GDP share declines during USD bear markets, suggesting reduced influence and potential currency substitution.

Consider the history of dollar bear markets. The left-hand chart below highlights bear markets in the DXY in the 1970s (A), the late 1980s/early 1990s (B) and the 2000s (C). And the right-hand chart shows how the U.S. share of global nominal GDP declined during each of those periods

Source – 13D Publications

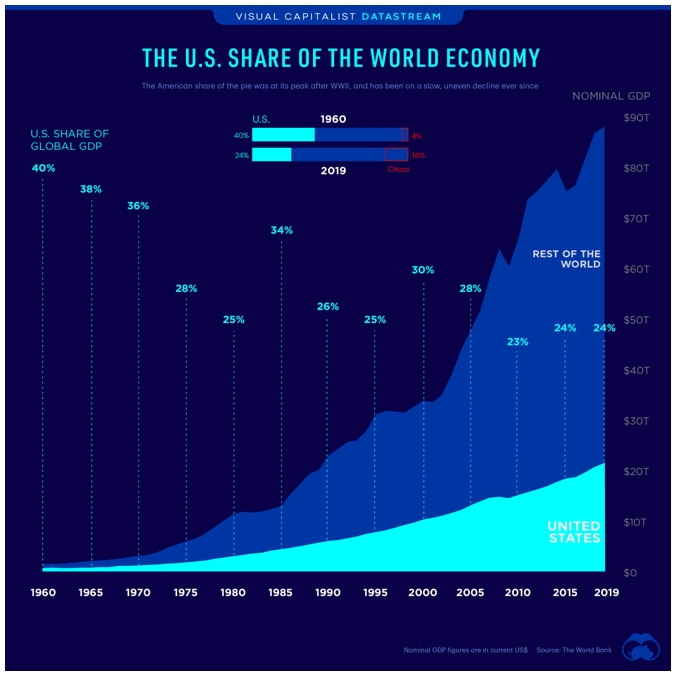

The U.S. share of global GDP has dropped from over ~35% in 1970 (chart below) to 26% in 2024 (Ranked: Largest economies in the world by Share of Global GDP (1980-2024) - CEOWORLD magazine) . Meanwhile, the U.S. stock market now makes up ~70% of the MSCI World Index (US Markets Represents 70% of Total World Market Capitalization - The Daily Upside) even though many U.S. companies earn revenue overseas. This shows that while the U.S. economy remains important, other countries are becoming more active in global trade, especially as they trade more among themselves due to tariffs and shifting dynamics.

Visualizing the U.S. Share of the Global Economy Over Time

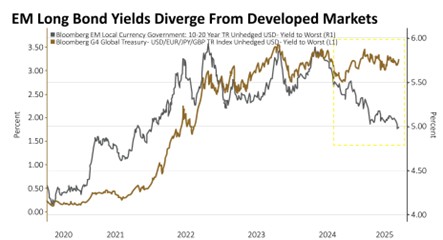

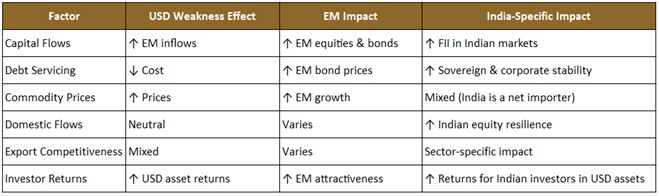

A weaker USD tends to benefit Emerging Market (EM) assets through several channels:

-

Capital Flows: Investors often seek higher returns in EMs when the dollar weakens, leading to increased inflows into EM equities and bonds.

-

Debt Servicing: Many EM countries issue debt in USD. A weaker dollar reduces the cost of servicing this debt, lowering default risk and tightening bond spread.

-

Commodity Prices: Since commodities are priced in USD, a weaker dollar typically boosts commodity prices, benefiting resource-rich EMs.

-

Carry Trade Revival: Lower US interest rates in a weak dollar environment can revive carry trades, where investors borrow in USD to invest in higher-yielding EM assets.

A weaker USD shifts investor sentiment and enhances the appeal of non-US assets, including emerging market bonds and equities. Studies show this typically fuels a reallocation of global portfolios, with local-currency EM debt attracting renewed interest. In fact, inflows into EM local debt have hit record highs in 2025, driven by double-digit returnsFor many EM nations with debt denominated in US dollars, the greenback’s decline offers direct relief—lowering the real cost of repayment, expanding fiscal flexibility, and reducing default risk.

Source: Emerging Asia Bonds Are the New Standards for Fiscal Control - Bloomberg

However, as EM currencies strengthen against a weakening dollar, their exports become less competitive while imports become cheaper—creating economic friction. To manage this, many EM’s central banks maintain tight control over exchange rates, often intervening to avoid excessive appreciation. Such intervention could cap upside potential in their local currencies.

Summary of Correlations

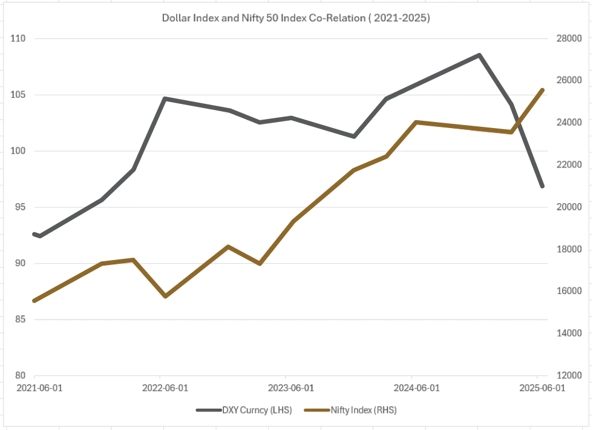

Historically, there has been an inverse relationship between the Nifty 50 index and the dollar currency index. This means that when the dollar currency index goes up, the Nifty 50 index tends to go down and vice versa.

Conclusion

Investors eyeing the Indian stock market should watch the Nifty 50 Index alongside the Dollar Currency Index. This relationship offers valuable insights into market movements and global influences.

However, it’s not a fixed equation. The correlation between these indices can shift due to economic, political, or global factors. A thorough analysis of the current environment is essential before making investment decisions.

Himani Shah

Co-Fund Manager

Alchemy Capital Management Pvt. Ltd.

Disclaimer: Investments are subject to market risks, please read all product /strategy related documents carefully before investing.

The discussion/ material is for informational purposes only. Please refer to our Disclaimer and Disclosures for more details..