Apr 2023

If you find this read interesting, share it on:

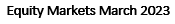

Analysis of key numbers for FY24 gives us some comfort on the broader markets. Valuations have meaningfully corrected and should be supportive. The earnings outlook also remains positive with consensus estimates indicating a broad-based recovery in FY24. The worries are that the macro could disappoint, triggering further downgrades. We believe that FY24 should provide modest, below-trend returns but the downside risks are also compressed. Sector rotation will continue, in our view, and valuations will be as important a determinant of stock returns and core fundamentals.

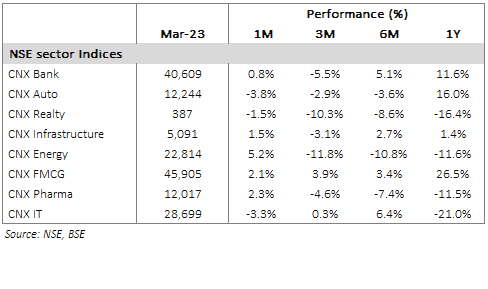

Valuations

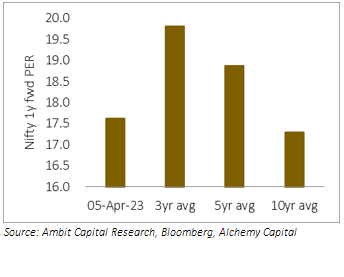

Valuations have meaningfully corrected and are now at 17.6x 1yf (as of 5 Apr 23) vs the peak of 22.5x in Oct-21. This is somewhat coloured by elevated consensus forecasts for FY24 (15% EPSg) but we believe that margin recovery still makes this an achievable target. To put it in context, as of 5-Apr- 23, Nifty PER is below the 3-year, 5-year and 10-year average. The attractive valuations imply that the downside for the broader market is limited from this level; the upside would be driven by earnings resilience and the trend in global and domestic monetary conditions.

Earnings Troughing Out

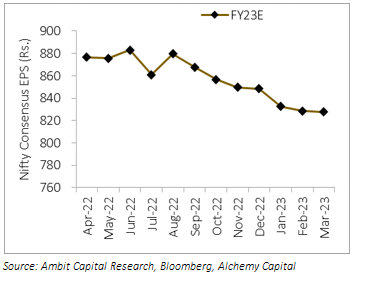

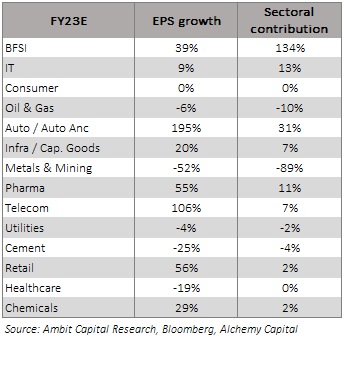

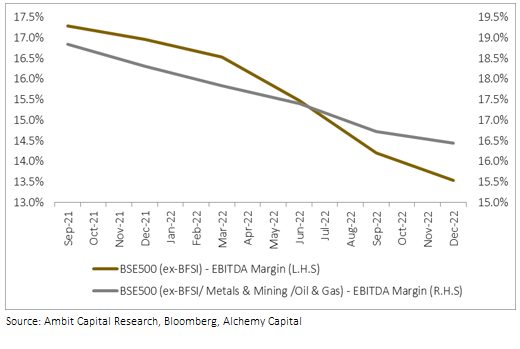

- FY23 earnings were disappointing. A 5.8% downgrade over a 12m period resulted in EPSg being pushed into single digits at 9.8%. Almost all the growth came from BFSI: ex-financials, the EPS was flat (+0.8% y/y). The major culprit was cost-led margins as commodity prices played havoc with manufacturer margins as the ferocity of the move, after the Ukraine war broke out, left producers little headroom to pass on the increased costs. This is still a consensus forecast and we shall know more about the outcome in the ensuing earnings season.

- The key to FY24 earnings recovery could be margins. We believe EBITDA margins should start to recover on the back of steady commodity prices, price hikes by producers and operating leverage – consensus is building that in. The risks, if any, are on topline growth. A high base and slowing demand are likely to drive slower revenue growth – some of that is built in to FY24 consensus estimates but there is some downside risk to that.

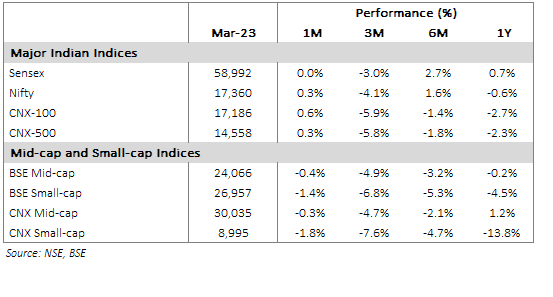

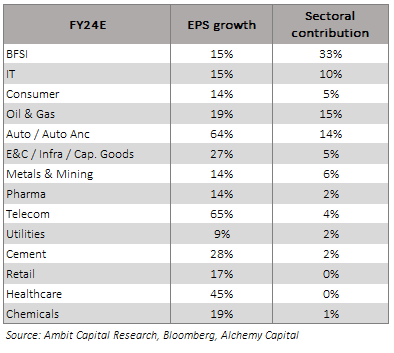

- The other positive is that earnings growth should be more broad-based. As discussed earlier, financials accounted for almost the entire EPSg for FY23. The growth is expected to be more well-distributed in FY24, with meaningful contributions from IT, Autos and Energy.

- The FY23 experience, however, keeps us on our toes. The double-digit EPSg expectations at the beginning of FY23 quickly faded into sustained downgrades are now at 9.8% y/y (as of 5-Apr-23). We do not expect such significant downgrades for FY24 but do see a couple of key risks. First, consumption is expected to slow on the back of a base effect and higher interest rates. Second, margin recovery is dependent on companies exercising pricing power and that may get spread out over a longer period than envisaged. Our base case, however, is that consensus earnings hold up, but we will monitor the risks.

Longer-Term Outlook

We believe that FY23/FY24 are speed-breakers in a positive medium-term India story. The key drivers of India’s medium term growth potential: positive demographics, economic reform, rapid digitisation, and the recovery in manufacturing remain intact and the cyclical slowdown does not negatively impact that. This, in our view, impacts the markets in two ways. First, it will keep valuations elevated as the premium for long-term potential remains sticky. Second, we believe it strengthens the case for holding quality companies as they are in a better position to weather the downturn and capitalise on the recovery when it happens.

Read our detailed blog on India’s long term potential from Aug-22.

Broader Market Theme: Quality + Valuations

We see three broad themes for FY24:

- Quality stocks would continue to be the focus. In a period of elevated global uncertainty, high commodity prices and tight monetary conditions, low-quality companies become more vulnerable and present asymmetric risk-reward risk (negatively). After a brief spell of underperformance in 2HCY22, we see quality ruling the markets in the coming year.

- Valuations, however, will be key to picking winners. Fundamentals and quality act as great filters, but stock performance is being increasingly driven by valuations. We are seeing an intensifying trend where richly valued stocks are struggling to outperform and relatively cheaper stocks are doing better.

- Sector rotation is likely to continue. As the broader market may not show clear trends, investors are likely to keep shifting between sectors, driven by relative valuations and short-term fundamental outlook. Investors with relatively longer-term horizons, we believe, will have to adapt. On the one hand, following short term trends is likely. On the other hand, ignoring relative valuations can lead to underperformance. The truth, as always, will be in the middle.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|748A86EB-62D6-4005-A2F7-245FB1813EF2