Get Familiar with Quant Funds: Purpose, Process and Risks

Thriving industries across the globe are actively looking to tap into the potential of data, the oil that fuels today’s digital economy. The same stands true for the investment sector, and the rise of quantitative funds vouches for this fact.

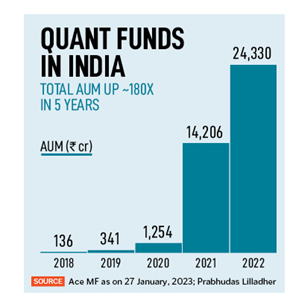

Quant funds have emerged as a significant and increasingly popular investment tool for investors seeking to enhance portfolio diversification, improve risk-adjusted returns, and access innovative investment methods leveraging advanced quantitative technologies.

Source: Forbes India article dated May 2023

In this blog, we will delve deep into the concept of quant funds, exploring their purpose, process, performance, and the risks involved.

What Are Quant Funds?

Quant funds leverage quantitative analysis and mathematical models to make investment decisions. They employ computerized algorithms to process large amounts of data, identify patterns, and execute trades. These strategies can be applied across various asset classes, including equities, fixed income, currencies, and derivatives markets.

Here are the factors highlighting the significance of quant funds:

1. Data-Driven Approach:

Quantitative funds leverage data analysis and statistical models to drive investment decisions. By systematically analyzing historical market data and fundamental metrics, quant funds aim to identify investment opportunities and manage risk effectively.

2. Enhanced Efficiency:

With the use of algorithmic trading techniques, quant funds can exploit short-term market inefficiencies, execute trades at optimal prices, and adjust portfolio positions dynamically in response to changing market conditions.

3. Risk Management:

By utilizing risk models and diversification techniques, quant funds seek to achieve optimal risk-adjusted returns while minimizing downside risk. Quantitative risk management allows investors to better understand and mitigate various types of risk.

4. Innovation & Research:

Quantitative researchers continuously refine and improve their models based on empirical evidence and market data, contributing to advancements in finance theory and practice.

5. Access to Alpha:

By employing quantitative models and advanced statistical techniques, quant funds aim to identify unique investment opportunities and generate consistent returns for investors.

How Quant Funds Work?

1. Data Collection and Processing:

Quantitative funds start by collecting vast amounts of financial data from various sources, including market prices, company fundamentals, economic indicators, and news sentiment. This data is then processed, cleaned, and standardized to make it suitable for analysis.

2. Model Development:

Quantitative analysts, or quants, develop mathematical models and statistical algorithms to analyze the data and extract investment insights. Quants use historical data to back-test and validate their models before deploying them in live trading.

3. Signal Generation:

Quantitative models generate signals or indicators that provide buy, sell, or hold recommendations for individual securities or asset classes. These signals are based on predefined criteria, such as price movements, valuation metrics, or technical indicators.

4. Portfolio Construction:

Based on the signals generated by the quantitative models, quant funds construct portfolios that seek to maximize returns while controlling risk. The techniques may include mean-variance optimization, risk parity, factor-based allocation, and dynamic asset allocation strategies.

5. Execution:

Quant funds execute trades using automated trading systems or algorithmic trading platforms. They ensure the efficient execution of trades while minimizing market impact. The feature commonly applies to short-term trading strategies.

6. Monitoring & Risk Management:

Risk management systems are used to assess and control various types of risk, including market risk, credit risk, liquidity risk, and operational risk. Quantitative risk models employ statistical techniques to measure portfolio volatility, drawdowns, and other risk metrics.

7. Evaluation & Optimization:

Quantitative funds regularly evaluate the performance of their models using historical data and performance metrics such as Sharpe ratio, alpha, beta, and tracking error. They may refine and optimize their models based on new data and changing market dynamics.

Alchemy Capital - Portfolio Management Services in India

Alchemy Capital Management is one of the leading providers of bespoke Portfolio Management Services in India. We cater to high-net-worth individuals, family offices, and institutions.

Pioneers in the bottom-up stock-picking approach, Alchemy places a strong emphasis on thorough research and long-term investments. With a legacy of over 22 years, Alchemy has built a reputation for trust, integrity, and expertise. Our experienced team of professionals possesses deep industry knowledge, enabling the firm to navigate market cycles and trends successfully. Start your investment journey in quant funds with us; here is a glimpse into our quant PMS strategies:

1. Alchemy Ascent:

This is a multi-cap investment quant strategy focused on 25-30 stocks designed to identify high-quality growth that can deliver superior risk-adjusted returns.

2. Alchemy Alpha 100:

This is a large-cap-focused quant strategy to provide a consistent ‘alpha’ investment strategy that builds and manages portfolios to deliver consistent outperformance over the long term.

3. Alchemy Smart Alpha 250:

This is a large and mid-cap-focused strategy that combines Quant and Active PMS portfolio management approaches, aiming to provide a consistent alpha over the long term.

To know more, write to us at contactus@alchemycapital.com

This blog is for informational purposes only and should not be considered as an offer or solicitation to buy or sell any securities or make any investments. We recommend readers to take independent advice before taking any investment decisions. Please refer to our Disclaimer and Disclosures for more details.